Healthcare Equity Research: In-Depth Market Capitalization Analysis and Sector Insights

- Lorenzo Agostini

- Sep 29, 2024

- 12 min read

Updated: Oct 7, 2024

Introduction

The healthcare sector stands as a fundamental pillar of the global economy, playing a crucial role in enhancing quality of life, increasing life expectancy, and fostering medical innovation. Spanning a broad array of subsectors, from drug manufacturing and biotechnology to medical devices and healthcare plans, the healthcare industry has a significant impact across multiple domains. To characterize the healthcare equity landscape, we analyze the market capitalization distribution across these subsectors, shedding light on the dynamics, trends, and growth opportunities within the sector. This report further provides key challenges and subsector-specific developments.

1. Overview of Healthcare Subsectors by Market Capitalization

The healthcare sector is a complex and highly segmented industry, with each subsector contributing uniquely to its overall market strength and playing an essential role in shaping the direction of the industry. This section offers a comprehensive breakdown of market capitalization across key subsectors, highlighting not only their individual contributions but also the challenges and growth opportunities they present. The distribution analysis, as depicted in the following figure, provides stakeholders with valuable insights into how value is concentrated across the sector, while also illustrating the interconnectedness of these subsectors and their collective impact on the broader healthcare landscape.

Market Cap Distribution by Subsector (Large, Mid, Small Cap). Companies with duplicate listings across exchanges are filtered out (so only the primary listing is considered for the analysis). Data is sourced from Financial Modeling Prep (FMP). This report is for informational purposes only and does not constitute financial advice.

2. In-Depth Analysis of Key Subsectors

2.1 Drug Manufacturers - General

Overview:

Total Market Cap: $3.138 trillion

Number of Companies: 17

Dominant Companies: Eli Lilly (LLY), Johnson & Johnson (JNJ), AbbVie (ABBV)

Market Cap Distribution for Drug Manufacturers - General (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data is sourced from FMP. This report is for informational purposes only and does not constitute financial advice.

Notable Developments: The Drug Manufacturers - General subsector consists of pharmaceutical giants that lead the industry in global healthcare solutions. These companies are deeply invested in research and development (R&D), particularly focused on chronic conditions like cancer, diabetes, and cardiovascular disorders. Eli Lilly, with a market cap of $834.3 billion, stands out for its leadership in diabetes care with blockbuster drugs like Trulicity (which is a recombinant protein). The subsector, however, faces challenges from patent cliffs, where the expiration of key patents paves the way for generic drug competition. Companies like Pfizer and Johnson & Johnson are approaching key patent expirations that could affect revenue streams.

Insights:

Dominance of Big Pharma: Large-cap companies dominate the subsector, driving significant growth and market activity.

Biosimilars Expansion: The rise of biosimilars is altering the competitive landscape, offering cheaper alternatives to established biologics as patents expire.

2.2 Biotechnology

Overview:

Total Market Cap: $1.652 trillion

Number of Companies: 521

Leading Companies: Novo Nordisk (NVO), Vertex Pharmaceuticals (VRTX), Regeneron Pharmaceuticals (REGN)

Market Cap Distribution for Biotechnology (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: The biotechnology sector remains a powerhouse of innovation, leading advancements in gene therapies, immunotherapies, and personalized medicine. Novo Nordisk, with a market cap of $528 billion, is a leader in obesity and diabetes treatments, while Vertex Pharmaceuticals has established itself in the niche market of cystic fibrosis therapies. The biotech subsector is known for its high-risk, high-reward profile, where companies like Prometheus Biosciences highlight the balance between substantial R&D investments and uncertain outcomes.

Notable Developments:

Recombinant Proteins: Recombinant proteins continue to play a significant role in biotech innovation, especially in addressing autoimmune diseases and cancer. Regeneron Pharmaceuticals, with its well-known monoclonal antibody therapy, Dupixent, is a key player in this space, offering treatment for conditions such as eczema and asthma. Another example is argenx SE, which developed efgartigimod, a first-in-class antibody fragment therapy for autoimmune diseases like myasthenia gravis.

mRNA Technology: Companies like Moderna and BioNTech have disrupted the vaccine industry with mRNA technology, driving progress in other therapeutic areas such as cancer treatments.

Gene Therapy: CRISPR Therapeutics and similar firms are at the forefront of gene-editing technologies, which hold the potential to revolutionize treatments for inherited diseases.

2.3 Medical - Healthcare Plans

Overview:

Total Market Cap: $939 billion

Number of Companies: 11

Leading Companies: UnitedHealth Group (UNH), Elevance Health (ELV), Cigna Corporation (CI)

Market Cap Distribution for Medical - Healthcare plans (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Insights: Healthcare plans are evolving rapidly, with a shift toward value-based care that emphasizes patient outcomes over service volume. UnitedHealth Group, with its $537.3 billion market cap, leads the charge by integrating healthcare services and data analytics through its Optum subsidiary. The Medicare Advantage market is expanding, driven by the aging U.S. population, with Elevance Health and Humana leading growth efforts in this area.

Notable Developments:

Vertical Integration: Companies like UnitedHealth are increasingly integrating with pharmacy benefit managers (PBMs) and healthcare providers to control more aspects of care delivery and reduce costs.

2.4 Medical - Devices

Overview:

Total Market Cap: $909 billion

Number of Companies: 107

Key Players: Abbott Laboratories (ABT), Stryker Corporation (SYK), Boston Scientific Corporation (BSX)

Market Cap Distribution for Medical - Devices (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Observations: The medical devices sector thrives on technological innovations, with major breakthroughs in minimally invasive procedures, wearables, and remote monitoring devices. Stryker and Abbott Laboratories, with a combined market cap of 332.9 billion, are pushing the boundaries with cardiovascular and orthopedic devices. The aging populations in developed countries are driving increased demand for these devices to address chronic conditions such as diabetes, heart disease, and joint problems.

Key Developments:

Wearables and Remote Monitoring: Medical devices like glucose monitors, heart rate trackers, and fitness wearables allow patients to manage chronic conditions remotely, minimizing hospital visits and improving care.

2.5 Medical - Diagnostics & Research

Overview:

Total Market Cap: $846.5 billion

Number of Companies: 49

Key Players: Thermo Fisher Scientific (TMO), Danaher (DHR), IQVIA Holdings (IQV), Agilent Technologies (A), IDEXX Laboratories (IDXX)

Market Cap Distribution for Medical - Diagnostics & Research (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Points: The Medical - Diagnostics & Research subsector is a vital component of healthcare, advancing early disease detection and personalized medicine. Thermo Fisher Scientific, with a market cap of $234.7 billion, leads the industry with its comprehensive portfolio of diagnostic equipment, reagents, and genomic tools. Other major players like Danaher and Agilent are also key contributors to innovations in precision medicine and research tools.

Notable Developments:

The Medical - Diagnostics & Research subsector is a vital component of healthcare, advancing early disease detection and personalized medicine. Thermo Fisher Scientific, with a market cap of $234.7 billion, leads the industry with its comprehensive portfolio of diagnostic equipment, reagents, and genomic tools. Other major players like Danaher and Agilent are also key contributors to innovations in precision medicine and research tools.

Insights: This subsector's synergy between diagnostics and research is central to healthcare's evolution. The integration of genomics, precision medicine, and advanced diagnostics enables earlier disease detection and personalized treatment plans, enhancing patient outcomes. As technological advancements continue to drive down the costs of genomic sequencing and diagnostics, companies in this subsector are positioned for sustained growth and innovation.

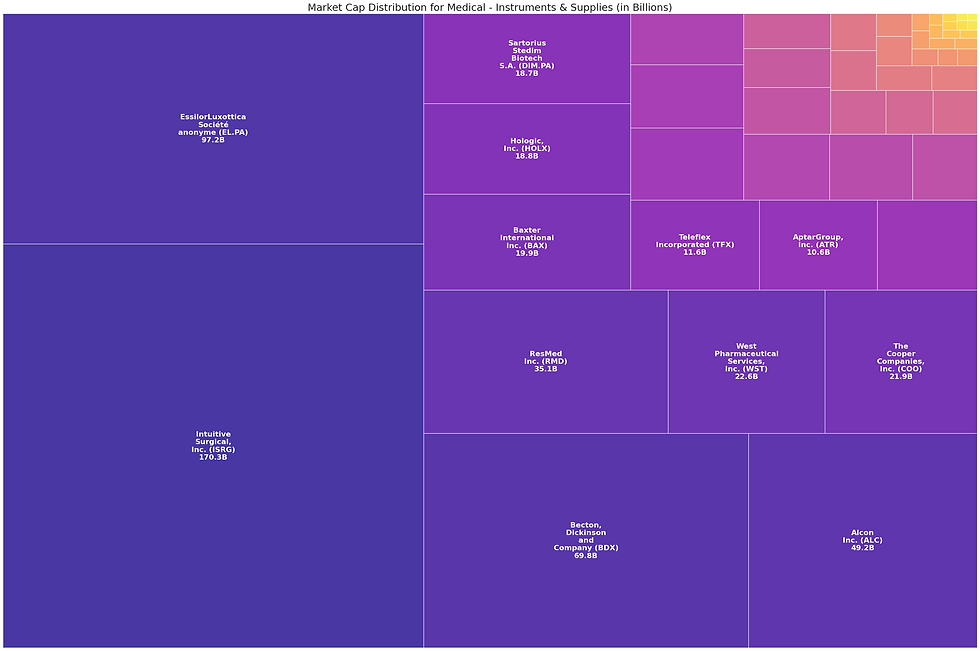

2.6 Medical - Instruments & Supplies

Overview:

Total Market Cap: $619.3 billion

Number of Companies: 48

Leading Companies: Intuitive Surgical (ISRG), EssilorLuxottica (EL.PA), Becton, Dickinson and Company (BDX)

Market Cap Distribution for Medical - Instruments & Supplies (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Points of Interest: The demand for surgical instruments and consumables remains high globally, particularly in expanding healthcare markets. Intuitive Surgical, with a market cap of $170.3 billion, stands out as a leader in robotic-assisted surgeries with its da Vinci systems. Its innovations have revolutionized minimally invasive surgery, providing greater precision and improving patient outcomes. Becton, Dickinson and Company, a key player in medical supplies, focuses on producing essential consumables such as syringes, needles, and catheters, which are critical in various healthcare settings.

Key Developments:

Robotic-Assisted Surgery: Intuitive Surgical has pioneered the development of robotic surgery with its da Vinci systems, enhancing surgical precision, reducing recovery times, and minimizing risks for patients.

Essential Medical Supplies: Companies like Becton, Dickinson continue to be key providers of essential medical consumables, which saw increased demand during the COVID-19 pandemic due to heightened infection control measures. The push for disposable medical supplies is growing as healthcare systems aim to reduce cross-contamination risks.

2.7 Drug Manufacturers - Specialty & Generic

Overview:

Total Market Cap: $342.7 billion

Number of Companies: 81

Leading Companies: Zoetis (ZTS), Haleon (HLN), Takeda Pharmaceutical (TAK)

Market Cap Distribution for Drug Manufacturers - Specialty & Generic (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: The Drug Manufacturers - Specialty & Generic subsector is evolving rapidly, driven by patent expirations of biologics and the rise of biosimilars. This subsector is essential in providing affordable alternatives to branded drugs, with companies like Zoetis and Haleon leading in their respective specialties. Zoetis, known for its focus on animal health, has been expanding its biosimilar portfolio, positioning itself to capture significant market share. Meanwhile, Haleon’s strength in consumer healthcare products and Takeda's diverse pipeline in specialty drugs contribute to the growing dynamics of this sector.

Notable Developments:

Biosimilars and Specialty Drugs Growth: With biologic drug patents expiring, companies such as Zoetis and Takeda are expanding their biosimilar portfolios to capitalize on the increasing demand for affordable biologic alternatives. The availability of biosimilars is expected to reduce costs and improve patient access to cutting-edge therapies, especially in oncology and autoimmune diseases.

Generic Drug Market Dynamics: Companies like Teva and Viatris continue to dominate the generic drug space, providing cost-effective alternatives to branded medications. However, the competition in the generic market is intensifying, prompting innovation in pricing strategies and product development. Viatris, formed through the merger of Mylan and Pfizer’s Upjohn, is a key player, leveraging scale to maintain competitive pricing and product availability.

Innovation and Consumer Healthcare: Haleon, with a market cap of $48.6 billion, focuses on consumer healthcare, offering over-the-counter products, oral health, and pain management solutions. The demand for such products remains strong, supported by an aging population and growing healthcare awareness. The company is also benefiting from the shift toward self-care and preventive healthcare products.

2.8 Medical - Care Facilities

Overview:

Total Market Cap: $273.2 billion

Number of Companies: 56

Leading Companies: Healthcare, Inc. (HCA),Tenet Healthcare Corporation (THC), DaVita Inc. (DVA), Universal Health Services, Inc. (UHS), Fresenius Medical Care AG & Co. KGaA (FMS)

Market Cap Distribution for Medical - Care Facilities (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: The aging population is driving increased demand for long-term care and specialized medical facilities. Companies like HCA Healthcare and Fresenius Medical Care are expanding their networks and investing in home care services to meet this rising demand.

Notable Developments:

Home Care Growth: A shift toward home care and telemedicine services, driven by patient demand for personalized care at home.

Investment in Long-Term Facilities: Companies are investing heavily in long-term care facilities to serve the elderly and those with chronic conditions.

2.9 Medical - Distribution

Overview:

Total Market Cap: $151.4 billion

Number of Companies: 11

Key Players: McKesson Corporation (MCK), Cencora (COR), Cardinal Health (CAH)

Market Cap Distribution for Medical - Distribution (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labeled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: Medical distribution companies are focused on optimizing supply chains, ensuring the efficient delivery of pharmaceutical and medical products worldwide. The COVID-19 pandemic highlighted the importance of robust distribution networks to ensure uninterrupted delivery of essential medical supplies.

Notable Developments:

Supply Chain Optimization: Companies are integrating digital logistics to enhance efficiency and reliability, particularly for temperature-sensitive products such as vaccines.

Global Reach: The rise of global healthcare demand is prompting distribution companies to strengthen their international logistics capabilities.

2.10 Medical - Healthcare Information Services

Overview:

Total Market Cap: $147.1 billion

Number of Companies: 50

Key Players: GE Healthcare Technologies (GEHC), Veeva Systems (VEEV)

Market Cap Distribution for Medical - Healthcare Information Services (in Billions). The labelled companies within the heatmap represent only those classified as large cap, while mid and small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: This subsector is driving the digital transformation of healthcare through data management, telehealth, and electronic health records. Companies like Veeva Systems are helping healthcare providers optimize patient records, data analytics, and supply chain management.

Notable Developments:

AI-Powered Tools: Artificial intelligence tools are being integrated into healthcare information systems to enhance decision-making based on real-time patient data.

Health Data Security: With the rise of digital health, data security is becoming increasingly important. Companies are investing in cybersecurity solutions to protect sensitive healthcare information.

2.11 Healthcare

Overview:

Total Market Cap: $15.1 billion

Number of Companies: 7

Key Companies: Tempus AI (TEM), Guardian Pharmacy Services (GRDN)

Market Cap Distribution for Healthcare Companies (in Billions). The labelled companies within the heatmap represent only those classified as mid cap, while small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: AI-powered solutions are revolutionizing personalized healthcare, with companies like Tempus AI offering diagnostic and treatment platforms tailored to individual patients. Pharmacy networks like Guardian Pharmacy Services are expanding distribution services to meet patient demands for essential medications.

Notable Developments:

AI-Driven Healthcare: Companies are leveraging artificial intelligence to personalize treatments, detect diseases early, and improve overall healthcare delivery.

Pharmacy Network Expansion: The expansion of pharmacy distribution services is helping patients access critical medications more efficiently.

2.12 Medical - Pharmaceuticals

Overview:

Total Market Cap: $10.8 billion

Number of Companies: 8

Key Companies: Walgreens Boots Alliance (WBA), Harrow Health (HROW)

Market Cap Distribution for Medical - Pharmaceuticals (in Billions). The labelled companies within the heatmap represent only those classified as mid cap, while small cap companies are not labelled. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: Retail pharmacies are expanding their healthcare services by offering diagnostic tests, vaccinations, and telemedicine consultations within local pharmacies. Companies like Walgreens Boots Alliance are adapting to the rise of online pharmacies by enhancing e-commerce platforms and leveraging their brick-and-mortar presence.

Notable Developments:

Retail Pharmacy Expansion: Traditional pharmacies are incorporating healthcare services, making it easier for patients to access care locally.

E-Commerce in Pharmaceuticals: Online pharmacies are gaining market share, and traditional companies are adapting by building strong e-commerce platforms.

2.13 Medical - Specialties

Overview:

Total Market Cap: $435 million

Number of Companies: 2

Key Companies: Delcath Systems (DCTH), Accuray Incorporated (ARAY)

Market Cap Distribution for Medical - Specialties (in Billions). The labelled companies within the heatmap represent only those classified as small cap. Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

Key Insights: The medical specialties subsector focuses on niche healthcare markets such as oncology and radiation therapy. Despite its small market capitalization, this subsector is driving technological innovations in cancer treatment and radiation therapies.

Notable Developments:

Oncology Innovations: Companies like Delcath Systems are developing novel technologies for treating liver cancer.

Targeted Radiation Therapy: Accuray is leading the development of specialized radiation therapy techniques, allowing for more precise targeting of cancerous tissues.

3. Top Healthcare Companies by Market Capitalization

The healthcare sector's largest companies are dominated by drug manufacturers such as Eli Lilly, Johnson & Johnson, and AbbVie, which lead the market in R&D and global healthcare solutions. Biotechnology giants like Novo Nordisk and Vertex Pharmaceuticals contribute significant innovations, particularly in gene therapy and mRNA technologies. Medical device and healthcare plan companies, including Abbott Laboratories and UnitedHealth Group, reflect the sector's diversity and dynamic growth.

Top 20 Healthcare Companies by Market Capitalization (in Billion USD). Data adapted from FMP. This report is for informational purposes only and does not constitute financial advice.

4. Emerging Trends and Notable Developments

Growth in Biotechnology: Major breakthroughs in gene therapy, mRNA vaccines, and recombinant proteins continue to drive growth in biotechnology.

Diagnostics Boom: Precision medicine and early disease detection are reshaping the diagnostics market.

AI and Digital Health: The integration of AI and data-driven tools is transforming healthcare delivery and patient management.

5. Conclusion

The healthcare sector remains a critical driver of the global economy, offering substantial growth potential across various subsectors. The largest pharmaceutical and biotechnology firms lead the market, while smaller companies offer innovation and disruption opportunities. Stakeholders must closely monitor emerging technologies, consolidation trends, and evolving patient care models to stay ahead of industry shifts.

Disclaimer:

This research report contains information generated with the assistance of artificial intelligence. While every effort has been made to ensure accuracy and relevance, the analysis presented here may contain errors, omissions, or outdated data. Readers are encouraged to verify the information independently before making any decisions based on the content. This report is intended for informational purposes only and should not be considered professional or financial advice. Neither the author nor the AI service provider assumes responsibility for any inaccuracies or the use of the information provided.

Comments